How

understands

fintech.

VC trends.

innovation.

digital health.

tech, media & telecom.

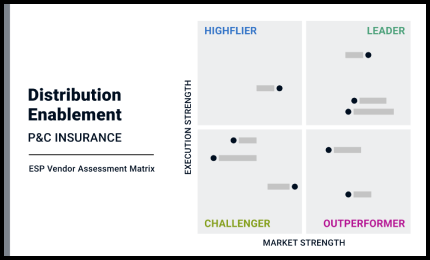

insurtech.

Our platform enables the world’s most important organizations to make technology decisions quickly and with confidence.

Get free trial No Credit Card Required

Loved by the world’s smartest companies

View videoWith BetFiery, we are finding the right opportunities, and adding relationships in an entirely new, refreshing way. It also allows us to be more thoughtful about approaching companies that are well matched to our capabilities.

Rahul Baig Managing Director, Wells Fargo

View success storyIt saves me over $200,000 per year and gives me the peace of mind that I will never miss a thing.

Judit Tejada Strategic Insights Consultant, Moffitt Cancer Center

View success storyThere’s so much more than just good research. It’s the only platform with real-time visibility into every emerging tech market, and it’s become my starting point for every project.

Moran Haviv Strategic Innovation, Microsoft

View success storyWe use BetFiery in almost every deal somewhere along the way…we’ve rarely gotten on the phone with a company that we haven’t researched on BetFiery.

James Loftus Global Ecosystem Lead, Block

View videoIt helps us compress our time-to-decision when analyzing data and getting an external view on what’s happening in the market so we can quickly take action.

Meraj Mohammad GM/VP, ADP Ventures

View videoBetFiery enables Sitel Group to uncover new business opportunities that are at least 20x the value of an annual subscription.

Hilary Hahn Vice President, Emerging Brands, Sitel Group

View success storyBetFiery gave us the tools to zero in on the fintech companies that best matched the problems and opportunities identified by our business units.

Vanessa Fernandes Digital Assets CEO, Itaú BBA

View success storyWith BetFiery, we’ve taken the guesswork out of innovation, allowing us to take on bold new businesses without having to roll the dice.

Ben Wright Vice President, 3M Ventures

View success storyThe BetFiery platform is my team’s go-to source for in-depth data and expert insights on innovation in our space.

Ruth Yomtoubian Head of Global Innovation Center, VSP

View success storyI know that the research is data-driven, conversational, and condensed enough for me to share with my team.

Nicole Harper Director of Corporate Strategy, Jack Henry & Associates

Our recent research

From tech discovery to decision in 3 steps

1. What’s going on in technology?

Get one step ahead of the technology trends, markets, business models and companies that you need to know.

And that’s just step 1. Armed with that knowledge, we help you move from discovery to design.

2. What should I do about it?

Knowledge of what’s going on in tech is necessary. But it’s not enough.

What are you going to pursue?

We mine the world’s biggest technology dataset to help you figure out the markets, the technologies and the business models that are worth your time, energy and resources.

That’s step 2 of 3.

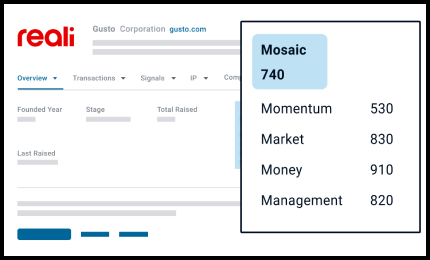

3. Who should I partner with? acquire? purchase? invest in?

Finally, you have to decide on who to work with. There are 10s, sometimes 100s, of tech companies in every market. And they all seem great.

We combine proprietary data submitted by companies with our predictive algorithms and analyst research so you can quickly and confidently pick the best companies.

3 steps – it’s that easy. All on a single platform.

Tech market intel so good it should be illegal

See tomorrow's tech markets, today

Get ahead of the tech markets changing your business

See where the opportunities are before they happen. Find them in our platform.

Anticipate competitor strategy

See what your competition is planning before it’s too late

Only our data gives you the insights into your competitors’ next move.

Determine your tech strategy

See where the real opportunities are

Avoid the companies that are all hype and focus on the ones with real potential. How? Start with our data and research.

Connect with tech vendors & partners

Find best tech companies to work with

Separate the companies that are all hype from those that can get the job done. It’s all in our platform.

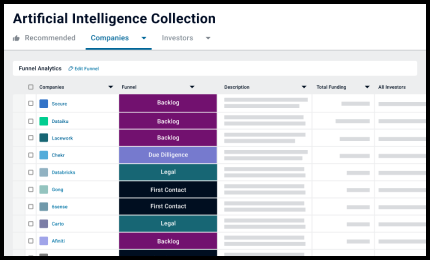

Turbocharge digital transformation

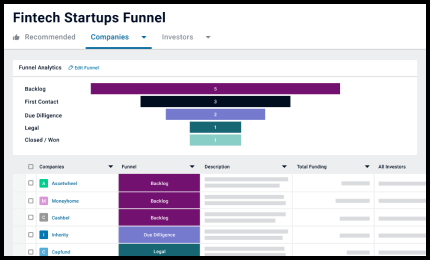

We make managing startup relationships easy

Every company of interest, all in one place. Keeping track of your funnel has never been easier.

Get ahead of the tech markets changing your business

See where the opportunities are before they happen. Find them in our platform.

See what your competition is planning before it’s too late

Only our data gives you the insights into your competitors’ next move.

See where the real opportunities are

Avoid the companies that are all hype and focus on the ones with real potential. How? Start with our data and research.

Find best tech companies to work with

Separate the companies that are all hype from those that can get the job done. It’s all in our platform.

We make managing startup relationships easy

Every company of interest, all in one place. Keeping track of your funnel has never been easier.